Just upload your form 16, claim your deductions and get your acknowledgment number online. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.Įfiling Income Tax Returns(ITR) is made easy with Clear platform.

It is a legal document used for financial reporting.Ĭlear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

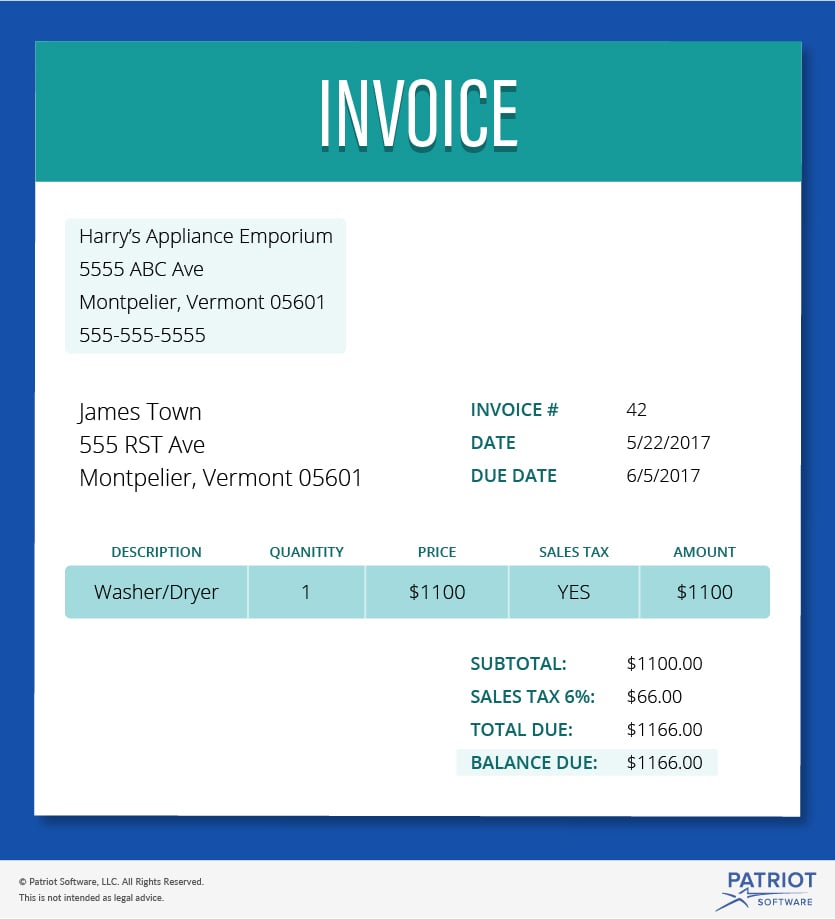

They are used to request payments from their customers for goods already sold or services already provided.īills are issued for cash transactions that are completed in one go.įor example, when Mr X has dinner at a restaurant, he will be issued a bill to be paid upfront. Invoices are usually used for credit transactions with specific due dates for payment. Even if they are numbered, it doesn't have significant legal importance as it is used only for the businesses’ administrative purposes. Invoices are assigned a unique invoice number for accounting and tax purposes.īills aren't numbered. Invoices are issued in a specified invoice template containing specific details such as invoice number, date of issue, due date, business name and contact details, customers contact details, tax details, amounts due, etc.īills usually don't contain customer information.īills contain limited details such as the amount charged for the sale, including any taxes charged on the same. The invoice contains customer information. Some of the differences between an invoice and a bill are discussed in the below table: Particulars

0 kommentar(er)

0 kommentar(er)